How to create a project budget

What is a project budget?

A project budget is a financial document that lays out what you think you’ll spend on a project. It covers all the (approved) expenses required to deliver the project.

In other words, it’s the way you answer the question: “How much is this project going to cost?”

The project budget might be phased over multiple quarters or years. It might include capital expenditure and operating expenditure. It’s the summary of how much you have been allocated to get the work done.

What does creating a project budget involve?

Creating a project budget involves:

- being able to identify all the items that are going to cost money, including staff costs

- building a complete picture of what you need to spend

- getting approval for that amount.

I have left items out of several project budgets and I can tell you it’s pretty embarrassing having to ask your project sponsor to approve spending from the reserves because you messed up the budget. So it’s worth spending some time on making sure your budget is comprehensive.

In this article we’ll look at how to segment costs, how to find out the cost of things, and then how to structure your budget.

This guide is most helpful for developing project budgets for projects that are approved or close to being approved, for example as input to a business case.

If you are planning a budget for a project proposal i.e. pitching to someone else for them to secure your services to deliver a piece of work, then read this article about preparing a budget for a proposal.

What is included in a project budget?

There are several ways of categorizing project cost for your project budget:

- Direct costs

- Indirect costs

- Capital costs (capex)

- Operating costs (opex)

- Project deliverable costs

- Project management costs

And your organization may have other standard ways of thinking about cost categories.

Let’s look at each of those in turn. They do have overlaps but that’s OK. It gives you another opportunity to check that you haven’t missed anything out.

Direct/Indirect Costs

The first way to think about your project costs is to consider what’s a direct cost and what’s an indirect cost. I find this helps me establish what’s in the project budget and what isn’t. So, let’s take direct costs first.

Direct costs

Direct costs are going to form the bulk of your project budget. They are the things that you have to buy or pay for in order to move the project along. Developing some new software? You’ll need hardware to run it on and software licenses. Designing a new product? You’ll need to buy manufacturing equipment and raw materials.

These are what you would normally think of as project costs and tend to be quite easy to identify. Talk to your team and brainstorm all the items that you need to procure using your work breakdown structure as a prompt.

Indirect costs

Indirect costs are the costs involved with keeping the project team running. They are the costs of doing business and are not normally included in project budgets.

For example, salaries, national insurance costs and tax contributions for the people who are working on the project. These are simply the cost of having resources and if they are employed staff you wouldn’t expect to account for these (some companies do cross-charge internal people costs on a flat fixed rate per employee type – check if you aren’t sure).

Indirect costs include the cost of heating, lighting, tea bags for the office, refuse collection and so on. Again, you wouldn’t normally include these costs in your budget unless your project is about opening a new office.

Don’t routinely put these costs in your project budget – if you have any doubts or you think they (or some of them) should go in, check with your finance team.

Capex/Opex Costs

Another way to categorize expenditure is into capital and operating expenses (often shortened to capex and opex). Let’s look at those next.

Capital costs

Capital costs are what are incurred when you buy stuff. Spending capital gives you assets for the company. This could be a new fork-lift truck or a patent application, but you get something tangible at the end of the day.

Capital costs are also involved when your current project includes upgrading an existing asset or repairing something that is broken to extend its life. That covers everything from adding a few new features to some software to major repair works at an oil refinery.

Capital costs represent an investment in the organization, and an investment that you will benefit from over several years, if not longer.

Operating costs

Operating costs are to do with running the project and the team, a bit like the indirect costs category.

They are accounted for differently to capex as they hit the profit and loss accounts. Capital can be managed as a different type of expense on the balance sheet but opex hits your bottom line.

Operating costs on projects include labor costs and training. (Sometimes you can capitalize staff costs if they are directly involved with bringing an asset into service — check your local accounting practice.)

Travel expenses and catered lunches are also opex, along with any routine maintenance, licencing and support fees that aren’t to do with new things your project is making or buying.

Project communications often fall into opex too, so budget something for those. However, you can do project comms on a very small budget (or none at all).

Operating costs don’t give you assets and they don’t represent a long-term investment in assets. I have to say that sometimes it can seem like semantics: surely a training course is a long-term investment in me?

I’ve always explained it by saying that I don’t belong to the company: I’m not on the books as an asset as I am free to go and work elsewhere. So while the training course is a long-term investment in me, it only pays off if I stay.

Sometimes – and this is where it pays to check your own company’s rules – opex costs incurred in a project setting can be capitalized because they are related to bringing an asset into service. It gets complicated quite quickly – check if you aren’t sure or you’ll find yourself short of cash if these things aren’t factored in.

Deliverable/Management Costs

A further way to split costs for the purposes of creating your budget is into project deliverable costs and project management costs. Let’s take project deliverable costs first.

Project deliverable costs

Project deliverable costs are – you guessed it – the costs involved in creating a project deliverable. Take your work breakdown structure or your product breakdown structure and map out the costs involved in each chunk of work that relates to a deliverable.

The costs involved in delivering your project requirements can be relatively small, like printing charges at the local print shop for a training manual for 30 people. Or, of course, they can be gigantic, like the steel bill for the London Olympic stadiums.

Some of your deliverables may be manageable for free – not everything costs money to produce.

The total project deliverable costs would stay the same regardless of who took on management of the project or whether it is done by an in-house team or a contractor.

Project management costs

The project management costs for a project relate to the costs of running the project. That includes all the people and admin stuff like setting up the project management office (if it’s needed), any temporary staff or salaries for people on secondments, new licenses for new users on the project management software or wiki or whatever.

These costs would differ depending on who is doing the project management. If it is an in-house team it’s going to be a different proposition to outsourcing it all to a third party (who would typically be more expensive).

The Project budgeting process: How to structure your project budget

Top down budgeting is where the sponsor gives you the total amount available and you work out how you are going to split that.

Bottom up budgeting is where you work out the detailed cost of each item and the total of everything is the budget you ask for.

In reality, experience shows what happens is likely halfway between the two. You’ll work out what you need, and then someone will say, “But we only wanted to spend $x,” and you’ll have to take that top down approach into consideration and cut the budget in a different way to meet the expectation.

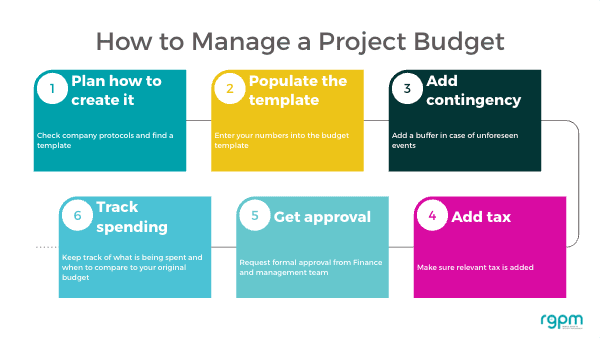

Effective project budgeting isn’t hard — here’s a simple process to create your budget. You might have to go through the whole cycle several times on complex projects as the numbers get refined.

Step 1: Plan how to document the budget

When you feel like you’ve got a comprehensive view of everything (and I mean everything) that your project needs to pay for, then you have to work out a way to represent that on paper (or electronically) so that you can track it accurately.

You may have written a project cost management plan as part of your overall project plan, so that will have the details of how you will approach managing the money.

Alternatively, your PMO may have guidance and templates for project managers required to plan, forecast and track spending.

Personally I like to use my own project budget template spreadsheet but many companies mandate the use of the project management office’s template, or a software application to do it for you. In many ways this can be easier because you don’t have to create anything from scratch.

Whatever you use, the important thing is that it is meaningful for you and that you know how to use it. If someone else has designed a tracking spreadsheet or template (for example, if you download the one I use), spend some time playing around with it so you know how the formulae work and how to input data.

Often I find that when someone else has done it you don’t always see how things link together until you’ve spent a bit of time with it.

Step 2: Populate the template

Then, populate your numbers with your cost estimates. Group your project expenditure into whatever categories make the most sense to you and total up the numbers to give you your grand project budget.

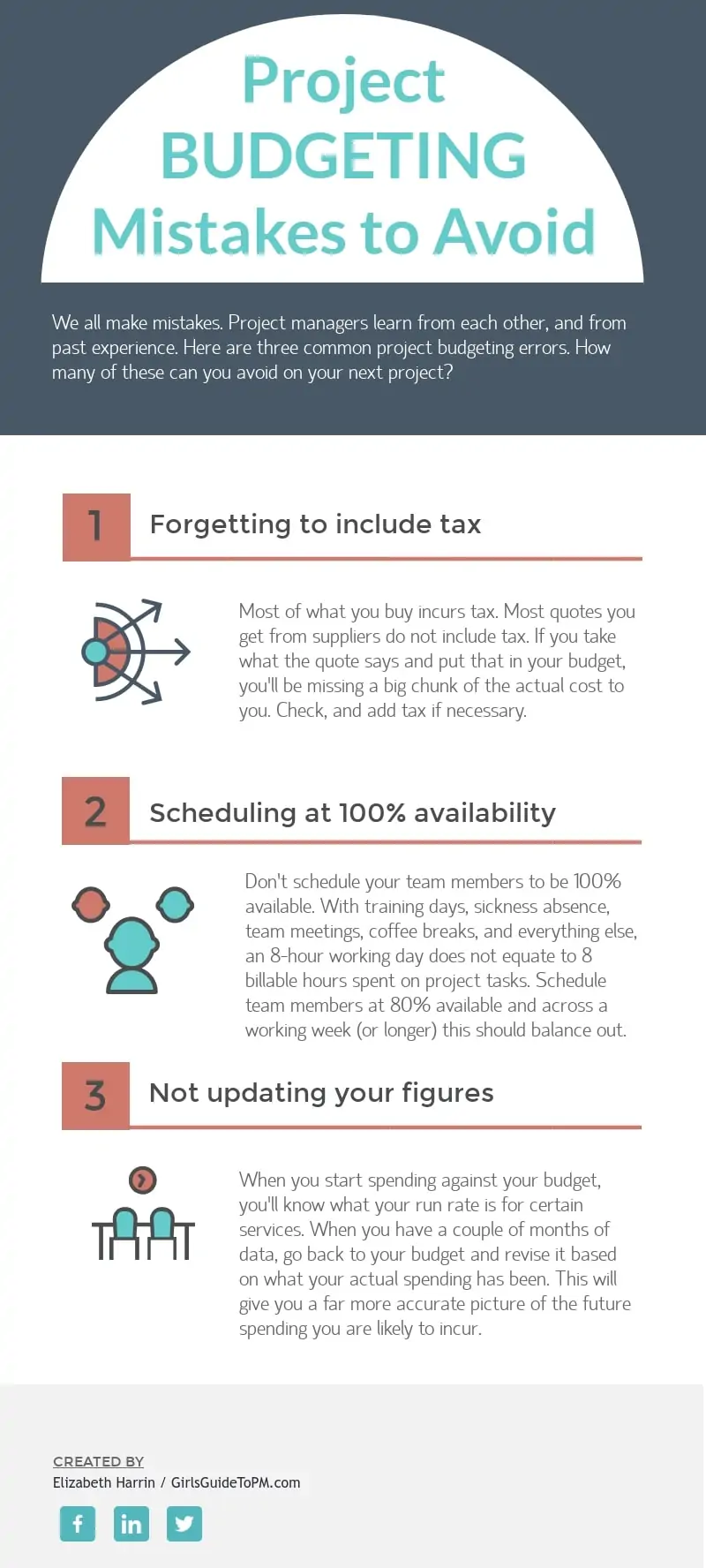

Sense check it to make sure you haven’t made any silly formulae errors or missed out a cell when totaling the numbers. For example, putting someone’s hourly rates as their day rate (not saying that’s ever happened to me, obvs).

Get someone else to read through it and check it for you if you don’t feel confident.

Accurate estimates give you an accurate budget. You can also look at previous projects to get some insight into how much items will cost to inform the budget for the entire project.

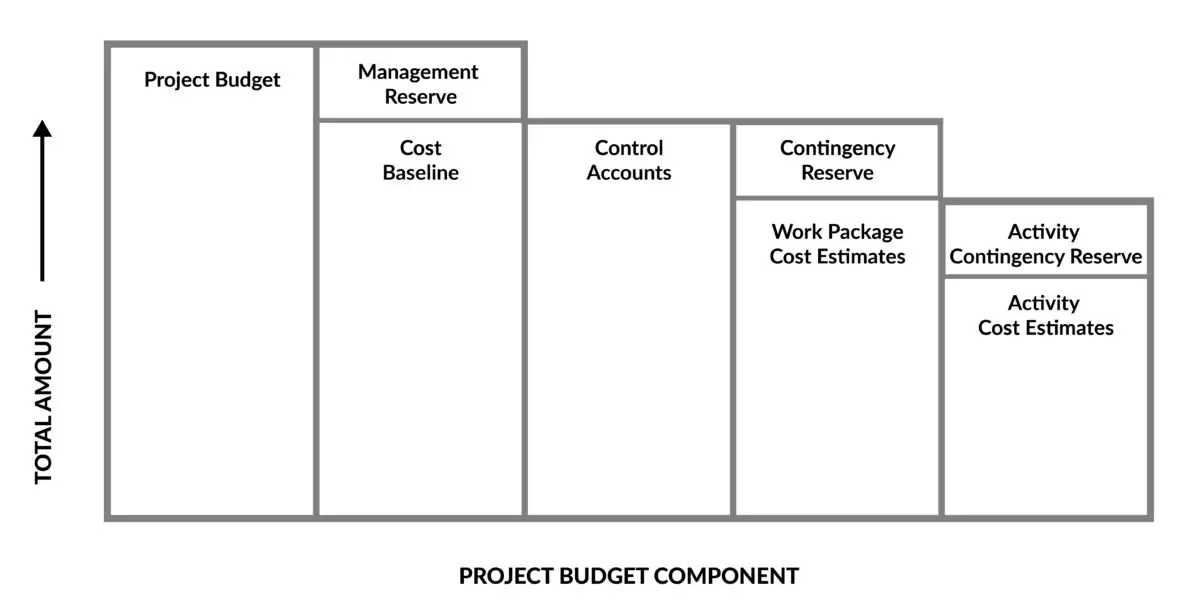

Step 3: Add contingency

Add contingency if you need to (you should work this out based on the risk profile of the project, as riskier projects will need more contingency). This is to cover unexpected costs. Then total it up again.

The contingency fund is (hopefully) available to you later if you should need it. I have used contingency reserves on my projects in the past, so if you can lobby to include it in the overall budget allocation, then you should!

Step 4: Add tax

Add taxes – many vendors will give you quotes without tax but as you actually do need to pay tax it is better to work your budget out on a comprehensive and tax-inclusive basis.

Check that tax is included in your detailed estimates. Then total the whole budget up again.

This is the number that you need to present to your sponsor, along with any notes and assumptions.

Step 5: Get budget approval

The figure for the project budget that you are now presenting for approval may be more than they were expecting. It may be within their anticipated range.

You may be asked to trim it down or put some more funding in. Ideally, it won’t take too many iterations before you have a number you believe in and that your sponsor will approve.

Feel free to challenge, especially if they are asking you to do more work for less money! If they want the work done, they have to pay for it.

Step 6: Track spending

When your budget is approved, you can start spending! Keep a record of everything that you buy so that you can track actual costs against your original budget.

Look out for cost overruns, scope creep, unexpected expenses and budget deviations from forecast. The earlier you can spot these, the easier it is to control project cost and get formal approval for any changes required if you need additional budget.

Your next steps

Creating a project budget isn’t that different from household budgeting except the numbers are larger (unless you live on a superyacht and are doing a small web project). Identifying everything upfront is the key and if you can do that, it’s plain sailing from then on.

Want to keep reading? Check out Project Budgeting: An Interview with Sol Benady for some practical tips about how to manage your budget once you’ve started the project.